- Home

- Who we are

- What we do

- How we do

- Invest with us

- Investor Relations

- Resources

- Blog

- Media

- Books

- Monthly Newsletter

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- Contact

FAQs

A Portfolio Management Services account is a customized investment account managed by professional fund managers backed by a research team on behalf of the client to generate optimum returns on their investments. PMS account is regulated by SEBI (Portfolio Managers) Regulations, 2020 as amended from time to time. It includes discretionary, non-discretionary and/or advisory services.

Under discretionary service, the decision of buying and selling of the securities as well as execution of trade lies wholly with the portfolio manager.

Under non-discretionary service, the decision of buying and selling of the securities lies wholly with the investor, the fund manager only suggests the investment ideas and executes the trade according to the final decision taken by the investor.

Under advisory service, the fund manager advises the investors based on securities but the decision of buying and selling of the securities as well as the execution of trade lies wholly with the investor.

According to the SEBI regulations, the minimum investment amount under Portfolio management service is Rs. 50 lacs. This amount is to be maintained since the beginning of investment.

Resident Indians, Non-Resident Indian, Individuals, Non-Individuals like HUFs, Partnership firm, Sole Proprietorship or any other corporate body can invest in Indian equities provided that the investor submits all the physical documents and details required to open their portfolio account. Necessary guidance and assistance will be duly provided to the Client on this regard.

Separate bank account will not be opened in the Client’s name instead we have opened a bank account with axis bank ltd at pool level in the name of the Company wherein the client’s funds can be deposited and/or withdrawn. Demat account will be opened with axis bank ltd for all resident clients.

An Indian Resident can have a joint account holder for their PMS account and three nominee(s) for their Demat account.

Clients can transfer listed and liquid securities into their demat account with KRIIS from the demat account (which is in the client’s name only).

The client will have to intimate us on our registered address info@kriis.in about the transfer of securities. The fund manager takes a final call on which stocks are to be transferred. We will then provide the client with a Client Master List which shall be forwarded to the broker to initiate the securities transfer process. The client will have to intimate us on our registered address info@kriis.in that the securities are transferred from their end. Once the securities are reflected in client’s demat account, confirmation on the same shall be given to the client on their registered email address.

Bank Name : Axis Bank Ltd

Bank Branch : Worli Naka Branch

Account Name : Kriis Portfolio Private Limited – Kriis Multicap Advantage Strategy

Account Type : Current Account

Account Number : 923020008392765

IFSC Code : UTIB0000653

MICR code : 400211054

Portfolio holders at KRIIS having maintained a fund of Rs.50 lakhs can opt for further investment through SIP. The minimum amount to start investment through SIP is Rs.1 lakh.

To start with the SIP plan, the client can either email us on our registered email address info@kriis.in or call us on +91 9082650622. Our Client relationship officer will connect with the client to elaborate the process and a reminder call shall be given to the client prior 4-5 days of SIP due date on their registered email address and contact details for smooth process.

Once the fund transfer process is initiated by the client, the same need to be informed to us on our registered email address info@kriis.in or call us on +91 9082650622. Once we receive the funds in the bank account, confirmation on the same shall be given to the client on their registered email address.

The client can also stop their SIP plan if required by intimating us on our email address info@kriis.in or may contact us on +91 9082650622.

The process to open a PMS account involves physical submission of all the necessary documents subject to the verification by us and the axis bank ltd. If all the physical documents are proper and there are no observations/objections/further requirements, demat account shall be opened within 3-4 working days. Once the account is opened, the client can either transfer funds and/or securities of mimimum Rs. 50 lacs to activate the account. After account is activated, signed copy of all the documents will be delivered by us at client’s registered address.

The client will get all concerning information, reports and statements with respect to their account. Demat account opening confirmation; monthly and annual statements; transfer of funds and/or securities related information; tax reports; fee payment reports etc will be provided to the client on their registered email address.

Below is the chart for tax treatment on capital gains for Indian Residents:

The client can at any time close the portfolio account by giving prior written notice on our email address info@kriis.in. Our Client relationship officer will connect with the client to elaborate the account closure process and with respect to the transfer of funds, securities and payment of performance fees. Also, the requisite account closure documents shall be provided to the client on your registered email address.

The Client shall have an option to either receive the Securities or the equivalent cash amount representing the Securities. This option shall be exercised by the client on the same day on which prior written notice is given to us on our email address info@kriis.in for an account closure.

In the event, the Client exercises an option to receive the Securities, we will require a prior written request on our email address info@kriis.in with a signed copy of a client master list with broker seal and signature in original wherein the securities are to be transferred. In the event, the Client exercises an option to receive the Securities in the form of cash, we shall endeavor to sell the Securities and pay the net proceeds thereof to the Client within a period of 10 days of closure request. Provided that, if for any reason, we are unable to sell the Securities, the Client shall be obliged to accept the Securities. Please be informed that the funds and/or securities will be transferred after deducting our performance fees and shall be intimated to the client on their registered email address.

The account will be set to close on receipt of the signed closure documents in original. Once the account is closed, the client will get a confirmation regarding the closure of the account on their registered email address.

There are no exit load charges while closing the PMS account.

Korea, Myanmar and Iran are the countries which are restricted/not permitted for PMS investment.

To start investing in Indian equities, every NRI will need a PAN Card.

NRIs should have a bank account for investment-related transactions.

NRO (Non-Resident Ordinary) Bank Account consists funds from India as well as foreign (NRIs residing) country whereas, NRE (Non- Resident External) Bank Account consists funds just from foreign (NRIs residing) country.

NRO funds are repatriable upto $ 1 Million in any year. However, client will have to submit 15CA & 15CB certificates at Axis Bank Ltd, Mumbai in originals to get the funds repatriated whereas NRE funds are completely repatriable.

NRE/NRO account holder needs to have a PIS (Portfolio Investment Scheme) account which holds special permission from RBI. The PIS number of NRE account is generated only once and tracked to ensure tax deduction. Whereas, the PIS number of NRO account is generated multiple times and tracked to ensure tax deduction.

Client’s NRE/NRO bank accounts will be opened in Axis Bank Ltd only. Managed by a custodian and with high security, banking with Axis Bank Ltd is completely effortless.

If client is an existing customer of Axis Bank Ltd, NRE & NRO – Extension form shall be provided to the client on their registered email address. If Re-KYC is due in Axis Bank Ltd, we would require self-attested KYC documents of the client or else all the KYC documents need to be notarised with self-attestation.

With Axis custodial service, the third party risk is eliminated as the bank directly pays to the stock exchange and the stock exchange directly credits the securities in the client’s demat account; likewise while selling the securities, the bank directly sells the securities to stock exchange and stock exchange directly credits the funds to the client’s account. This approach excludes the risk of involving broker account to transfer funds and ensure complete safety.

Client’s demat account will be opened with axis bank ltd for which they have to submit self-attested KYC documents in original.

The process to open a PMS account involves physical submission of all the necessary documents subject to the verification by us, bank and the Nuvama. If all the physical documents are proper and there are no observations/objections/further requirements, bank and demat account shall be opened within 7-10 working days. Once the account is opened, the client can either transfer funds and/or securities of mimimum Rs. 50 lacs to activate the account. After account is activated, signed copy of all the documents will be delivered by us at client’s registered address.

Any NRI or Indian citizen can be the joint account holder or nominee of the client’s account.

Funds can be transferred from an NRO to another NRO account but it cannot be transferred from an NRO to an NRE account whereas funds from NRE being a repatriable account is freely transferable to an NRO or an NRE account.

The client can transfer funds to their portfolio account on a regular basis through cheque or wire transfer. Bank details for transferring funds shall be provided to the client once the bank account is opened. Once the fund transfer process is initiated by the client, the same need to be informed to us on our registered email address info@kriis.in. Once we receive the funds in bank account, confirmation on the same shall be given to the client on their registered email address.

Clients can transfer listed and liquid securities into their demat account with KRIIS from the demat account (which is in the client’s name only).

The client will have to intimate us on our registered address info@kriis.in about the transfer of securities and need to provide the following documents for our accounting and proper presentation of future reports:

- Original Copy of No Objection Certificate (NOC)/Letter from Previous Bank with Stamp and Signature.

- Original Copy of Latest Holding Statement from Previous Bank (containing balance quantity, Purchase Date and Purchase Value/Purchase Rate per share) with Stamp and Signature.

- Latest Demat holding Statement.

The fund manager takes a final call on which stocks are to be transferred. We will then provide the client with a Client Master List which shall be forwarded to the broker to initiate the securities transfer process. The client will have to intimate us on our registered address info@kriis.in that the securities are transferred from their end. Once the securities are credited in the client’s demat account, confirmation on the same shall be provided to the client on their registered email address.

Bank, Demat account opening confirmation, monthly and annual statements, transfer of funds/securities related information, tax reports, fee payment reports will be provided to the client on their registered email address. Occasional and ad-hoc events like Re-KYC or any other account or securities related information will be communicated with the client on their registered email address.

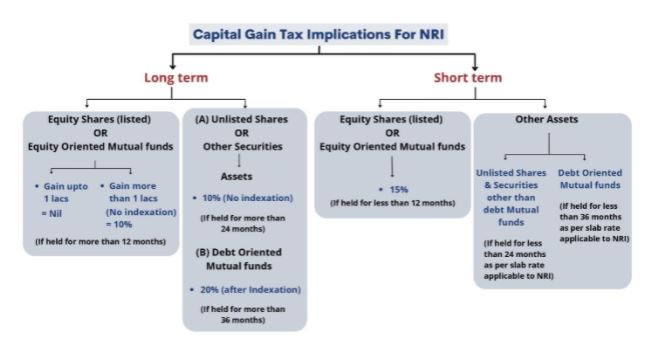

Below is the chart for tax treatment on capital gains for Non-Resident Indians;

The client can at any time close the portfolio account by giving prior written notice on our email address info@kriis.in. Our Client relationship officer will connect with the client to elaborate the account closure process and with respect to the transfer of funds, securities and payment of performance fees. Also, the requisite account closure documents shall be provided to the client on their registered email address.

The Client shall have an option to either receive the Securities or the equivalent cash amount representing the Securities. This option shall be exercised by the client on the same day on which prior written notice is given to us on our email address info@kriis.in for an account closure.

In the event, the Client exercises an option to receive the Securities, we will require a prior written request on our email address info@kriis.in with a signed copy of a client master list with broker seal and signature in original wherein the securities are to be transferred. In the event, the Client exercises an option to receive the Securities in the form of cash, we shall endeavor to sell the Securities and pay the net proceeds thereof to the Client within a period of 10 days of closure request. Provided that, if for any reason, we are unable to sell the Securities, the Client shall be obliged to accept the Securities. Please be informed that the funds and/or securities will be transferred after deducting our performance fees and shall be intimated to the client on their registered email address.

The account will be set to close on receipt of the signed closure documents in original. Once the account is closed, the client will get a confirmation regarding the closure of the account on their registered email address.

There are no exit load charges while closing the PMS account.

KRIIS Portfolio Pvt. Ltd. is a Portfolio Management Company registered with SEBI (No. INP000006545) and is subject to its rules and regulations regarding capital requirements, disclosure and auditing norms.

Ⓒ 2021 KRIIS | Designed & Developed with ❤️ By Brand My Style