Investment Philosophy

Our core philosophy is to first take care of downside risk as we believe that upsides can take care of themselves. So our framework revolves around capital protection in the long term followed by eventual capital appreciation.

The investment objective is to provide long term capital appreciation and generate returns by investing in a portfolio of quality companies with strong corporate governance and long term growth potential. The objective is also to create consistent alpha over benchmark indices for long term wealth creation for shareholders.

The portfolio companies should pass through certain checklists that are as follows:

1. Strong corporate governance history

2. Consistently high Return on Capital Employed

3. Consistent track record of revenue and EPS growth

4. Ability of the company to generate consistent free cash flows so that it should not resort to external finance

5. High growth outlook due to either market under penetration or significant potential to improve market share

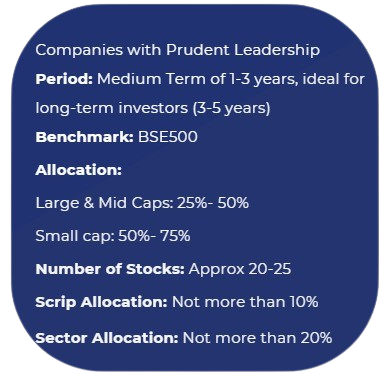

Strategy Construct