In spite of lackluster returns, Indian households have traditionally invested in real estate and gold and shied away from equities due to entrenched perceptions of risks associated with the stock market.

“Compound interest is the eighth wonder of the world. He who understands it, earns it …he who doesn’t … pays it.” – Albert Einstein

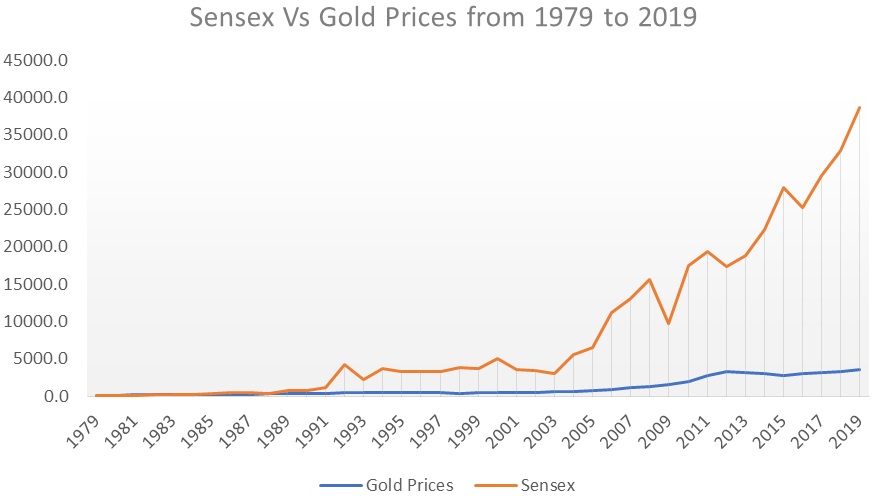

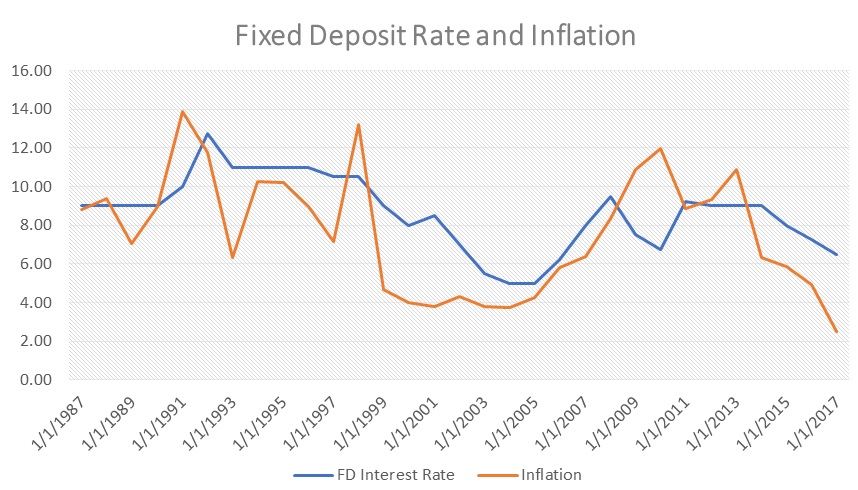

A hard look at historical data confirms that the compounded return on equities has far outperformed gold in the long term. Even though many have feared to dip their toes into the equity waters, fearing the risk, the fundamental principles of risk-return relationships hold true across the investment spectrum. One could say that a person can relate to the tangibility of investments like gold and real-estate but feels vulnerable about stocks that exist in dematerialized form and are beyond the reach of easy understanding. The disciplined expertise of a good fund manager becomes important to help one navigate the volatility of the stock market and achieve steady returns in the long term. The stock selection/portfolio construction made by an expert fund manager can generate a good risk-adjusted return.

In simple words equities is apart ownership in a business. The growth rate of any business is dependent on the economic growth of the country it operates in. In the last two decades, the real GDP growth of the Indian economy has been over 7% and the nominal GDP growth was over 9%. The demographic dividend and the low base of per capita income (~$2100) will help the Indian economy to grow in high single digits in the years to come. This ensures that equity markets will yield superior returns.

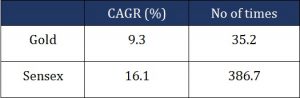

The last couple of have showed that inflation risk is high in emerging markets like India. The graph below shows the 1 year to less than 2 years fixed deposit rates offered by SBI (State Bank of India) and the inflation reported between 1987 to 2017.

It is quite clear from the graph that inflation has been almost as high as the FD rate. The real return (adjusted for inflation) in this period from 1987 to 2017 when compounded for 30 years is only approximately 34%. This makes the case for investing in equities quite compelling. In the words of the legendary investor Warren Buffett “Stocks are still the best of all the poor alternatives in an era of inflation”. Although gold might give a hedge against inflation and can outperform equities in period of extreme panic, over the long term it is evident that equities can generate higher returns. Diversifying adequate proportion of savings into stocks gives an investor a good hedge against inflation.

The real estate prices in India soared from 2003 to 2007. This was a period of high GDP growth and rapid urbanization in the country. As a result, real estate delivered excellent returns. However, over the last 8-10 years the prices in major cities are largely flat and affordability is a major concern. Moreover, the rental yields have been mostly in the range of 2-4% and hence not very lucrative to invest in the sector. In addition to that, real estate investments have some other disadvantages like high ticket size for properties in the major cities and lack of liquidity when there is an overall slowdown in the economy. At this point, we don’t have enough data from a credible source to compare the real estate returns and equity market returns in the last 30 years but is highly unlikely to beat an equity fund manager who has been consistently delivering alpha.

A long-term investor in equities can generate superior returns as long as he is disciplined and not swayed by the vagaries of the market.